ad valorem tax florida ballot

Proposing an amendment to the State Constitution to increase the homestead exemption by exempting the assessed valuation of homestead property greater than 100000 and up to 125000 for all levies other than school district levies. 1 The Board of County Commissioners or.

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

At least 60 of voters must approve an amendment for it to pass so it is vitally important that voters understand their far-reaching consequences that will affect Floridians for generations to come.

. 85-381 Laws of Florida Ch. Property Tax Oversight Program. As amended by Ch.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. 21812 Appropriations to offset reductions in ad valorem tax revenue in. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all other.

This question authorized the County of Alachua to renew a property tax levy of 1 mill 1 per 1000 of assessed valuation for 4 years in order to fund school improvement and school programs in the County. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. 101173 District millage elections.

Impact fees and user charges. Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com. Should voters approve the continuation of the tax the tax bill will not.

Pete that would create local jobs. Ad Valorem Tax Discount for Spouses of Certain. Section 1961995 Florida Statutes requires that a referendum be held if.

Increased Homestead Property Tax Exemption BALLOT SUMMARY. 1993 to permit any county or municipality to authorize ad valorem tax exemptions for owners of historic property to encourage the rehabilitation or renovation of such structures. An ad valorem tax levied by the board for operating.

Ad valorem tax florida ballot Wednesday February 16 2022 Edit. Article VII Finance and Taxation. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the district and to provide for any sinking or other funds established in connection with such bonds.

CONSTITUTIONAL AMENDMENT ARTICLE VII SECTION 3 ARTICLE XII SECTION 31 HOMESTEAD AD VALOREM TAX CREDIT FOR DEPLOYED MILITARY PERSONNEL. An Alachua County Ad Valorem Tax Renewal question is on the November 6 2012 election ballot in Alachua County which is in Florida where it was approved. An ad valorem tax levied by the board for operating purposes exclusive of debt service on bonds may not exceed 375 mills unless a higher amount has been previously authorized by law subject to a referendum as.

Proposing an amendment to the State Constitution effective January 1 1993 to permit any county or. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the district and to.

Florida Ballot Measure - Constitutional Amendment 2. 8 hours agoThe Lake County Commission recently sent an extension of the 075 mill or 75 cents for every 1000 of taxable value ad valorem. The 2021 Florida Statutes.

If enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all other. Under state law and the florida constitution cities are authorized to vote on economic development ad valorem tax exemptions that are valid for 10 years. 74-430 Laws of Florida provides that if the amount of ad valorem tax revenues for the proposed budget for operating funds of a governmental unit in Brevard County levying ad valorem taxes on all or part of the countys tax roll exceeds by ten percent the ad valorem tax revenues for operating funds of the preceding year.

1 1961995 economic development ad valorem tax exemption. 1 AD VALOREM TAXES. It was approved by a margin of 6698 to 3302.

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. Florida Department of Revenue. Ad valorem tax discount for surviving spouses of certain permanently disabled veteransThe amendment to Section 6 of Article VII relating to the ad valorem tax discount for spouses of certain deceased veterans who had permanent combat-related disabilities and this section shall take effect January 1 2021.

Historic Preservation Ad Valorem Tax Exemption Ballot Summary. Housing and Property Military Personnel Constitution Taxes. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all.

Currently it is a one mill ad valorem millage according to officials. Home ad ballot florida tax. 2 2010 General Outcome.

Six proposed constitutional amendments will be on the ballot Nov. Ballot measures in Florida. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment.

In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3 Florida Constitution and section 1961995 Florida Statutes for new businesses and expansions of existing businesses was placed on the ballot1.

Florida Voters Approve Amendment 4 10 Others Wusf Public Media

Why Some States Are Moving To Restrict Ballot Initiatives Democracy Docket

House Passes Ballot Measure For Extra Property Tax Break For Teachers First Responders

What To Know About Voting And The Florida Ballot For The 2020 Election

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Voter S Guide For Florida S 6 Proposed Constitutional Amendments

Florida Election Results The New York Times

On The Ballot Tampa Bay Communities To Vote On 32 Election Races Measures Nov 2 Wfla

Palm Beach County School District To Put Tax Referendum On Election Ballot

Florida Amendments16ge The League Of Women Voters Of Miami Dade

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

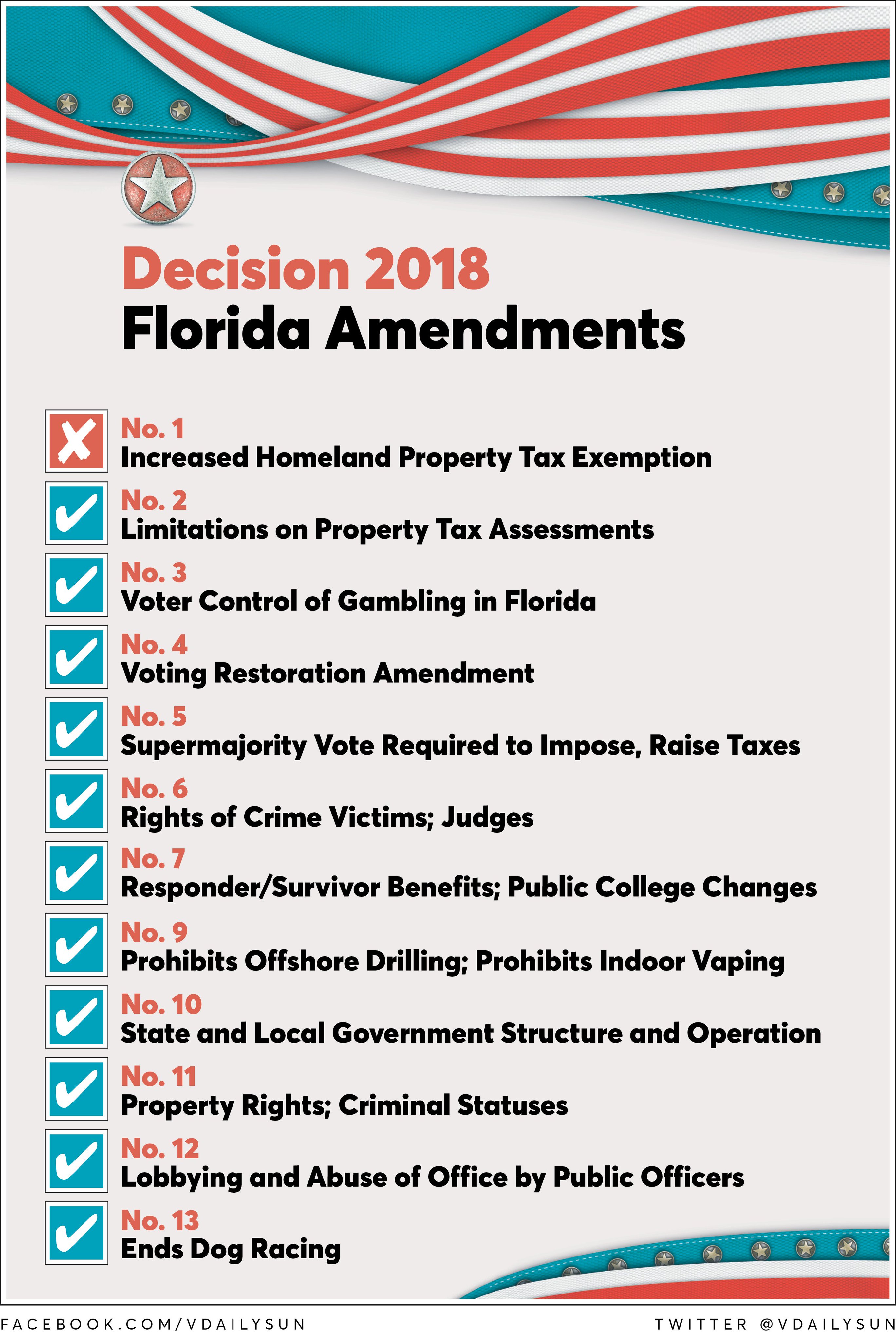

Thevillagesdailysun On Twitter 11 Out Of The 12 Amendments On Florida S Ballot Were Approved By Voters Amendments Need 60 Percent Of The Vote To Pass Https T Co Ezymbvxdre Twitter

2020 Florida Constitutional Amendments Ballot League Of Women Voters Of Orange County

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Voters Say Yes To Maintaining Single Member Districts School Funding Sarasota Magazine

Florida S Lake County To Let Voters Decide On Extending Property Tax For Schools Orlando Business Journal

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

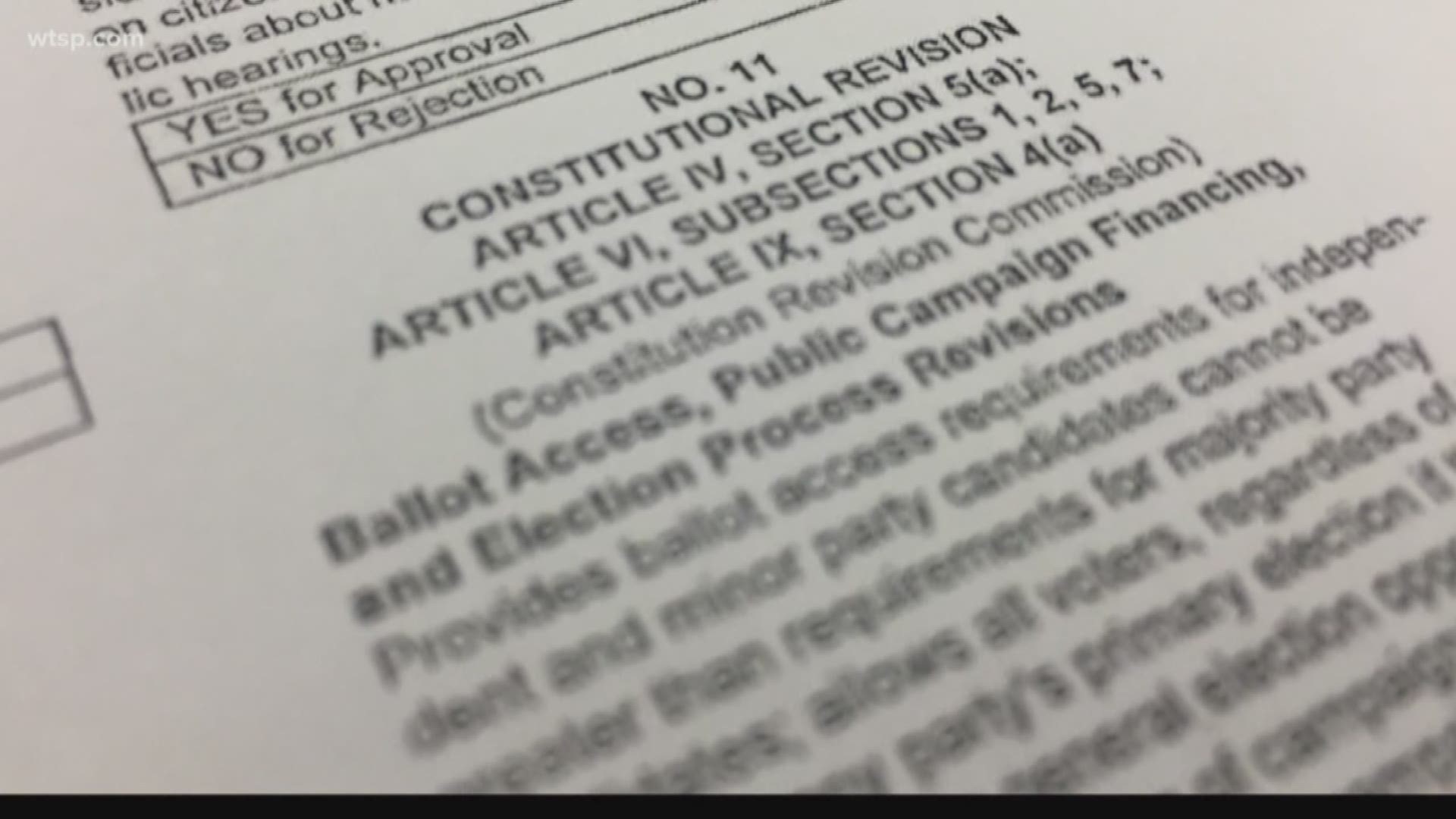

What Are The 12 Florida Constitutional Amendments On The 2018 Ballot Wtsp Com